Safaricom has unveiled the most significant upgrade to its M-PESA platform since 2015, introducing Fintech 2.0, a next-generation core system designed to enhance resilience, increase capacity, and drive AI-powered innovation.

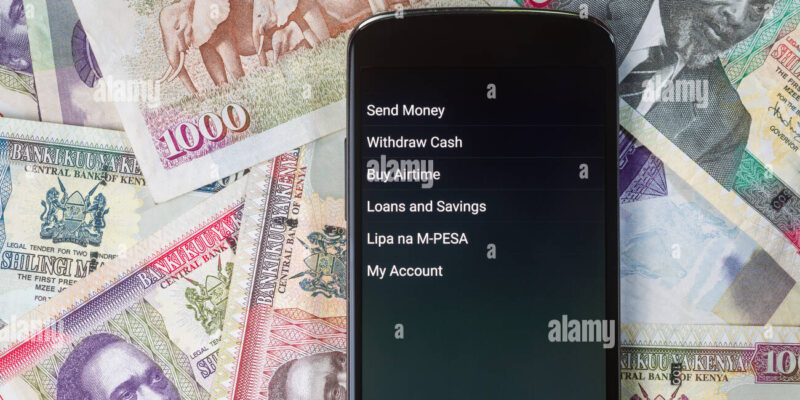

Initially focused on basic money transfers, the platform now enables secure digital payments, savings, microloans, and even government cash disbursements.

According to a report by Tech-in-Africa.com, seen by Zambia Monitor on Thursday, this upgrade increases the platform’s processing capability from 4,500 to 6,000 transactions per second, with potential scalability of up to 12,000 transactions per second to meet rising demand.

The system incorporates an active-active architecture across multiple hosting sites, ensuring higher resilience and minimal service interruptions.

“This upgrade is a bold investment in the future of M-PESA and a reaffirmation of our commitment to innovation, resilience, and customer trust. By transitioning to Fintech 2.0, we are unlocking a platform that not only scales to meet today’s demands but also anticipates future opportunities,” said Dr. Peter Ndegwa, Group Chief Executive Officer of Safaricom.

Fintech 2.0 integrates advanced artificial intelligence for enhanced fraud detection, self-healing capabilities, and real-time monitoring.

Its cloud-native infrastructure ensures faster performance, instant scalability, and rapid deployment of new products.

Since its inception, M-PESA has grown from a basic money transfer service into Africa’s largest fintech ecosystem, supporting payments, savings, credit, insurance, remittances, and e-commerce.

Safaricom says the new platform will continue to drive growth, support Africa’s expanding digital economy, and remain focused on making financial services simple, accessible, and inclusive for all.

WARNING ! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments