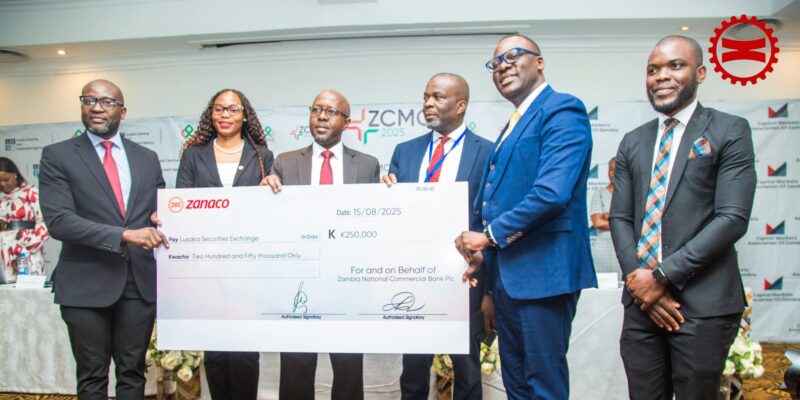

ZANACO Executive Head of Treasury, Frederick Mulenga, has highlighted the critical role of a vibrant capital market in strengthening economic resilience, as the Bank announced a K250,000 sponsorship for the Zambia Capital Market Conference and Awards.

Speaking at a Lusaka Securities Exchange (LuSE) press briefing in Lusaka, Mulenga said a robust capital market provided a sustainable channel for long-term financing, supports price discovery, and enhances liquidity.

“For investors, it offers transparent opportunities backed by strong governance,” he explained.

He added that for issuers—whether state-owned entities, private companies preparing for expansion, or infrastructure projects—the market provided an alternative to costlier debt and promoted a more stable funding mix.

Read more: ZANACO declares K134.4 million dividend to government on the back of K1.79 billion profit

“A healthy capital market also strengthens financial literacy and confidence among participants, broadening participation and deepening market depth,” Mulenga said.

He noted that ZANACO was committed to harnessing the power of capital markets to mobilise long-term funding for sustainable growth across Zambia.

“A thriving market channels savings into productive investment, enhances transparency and governance, and broadens participation—from large institutions to SMEs and retail investors,” he said.

Mulenga described the Bank’s K250,000 sponsorship as a tangible demonstration of its commitment to creating a more inclusive, efficient, and credible market ecosystem.

He said the conference would bring together thought leaders, policymakers, investors, issuers, and service providers to drive dialogue, innovation, and inclusive participation in Zambia’s capital markets.

“We commend LuSE for conceptualising this conference and the awards. Creating a dedicated platform for dialogue, learning, and recognition is crucial for Zambia’s capital markets. Market development is a collective endeavour—one that thrives on ongoing conversation, innovation, and exploring new approaches to financing and market access,” Mulenga said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments