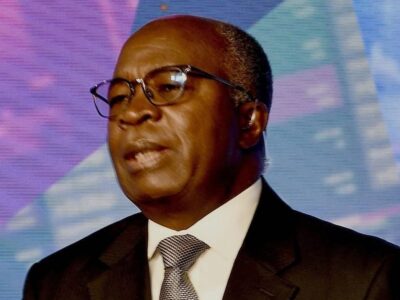

Former Kasenengwa Member of Parliament, Sensio Banda, has dismissed government’s claim that 94 percent of Zambia’s eligible debt has been restructured, describing it as diplomatic spin rather than financial reality.

Finance and National Planning Minister, Dr. Situmbeko Musokotwane, recently announced that 94 percent of the country’s eligible debt had been restructured based on the official creditors’ Memorandum of Understanding (MoU).

However, Banda told Zambia Monitor in an interview that the figure paints an overly optimistic picture that required critical scrutiny.

“The Minister’s defense rests on the premise that the MoU represents the successful restructuring of 94 percent of the debt. This position is flawed on many fronts,” Banda said.

He argued that while the MoU was a vital milestone, it should not be equated with completed restructuring, as it merely represents an agreement in principle, not a legally binding outcome.

“The MoU is non-binding in itself and only sets the stage for binding bilateral agreements. Actual debt restructuring is finalized when those individual, legally binding bilateral agreements are signed and executed,” he explained.

Banda argued that, according to Musokotwane’s own admission, only 57 percent of Zambia’s debt had been covered by concluded bilateral agreements with India, Saudi Arabia, France, and China.

“This 57 percent figure is the concrete measure of progress, not the 94 percent MoU figure,” he said.

He likened the government’s claim to “a celebratory snapshot of a half-built bridge,” warning that Zambia’s debt crisis remained unresolved until the remaining 43 percent of bilateral deals were finalized and a comparable agreement was reached with private Eurobond holders.

“To suggest otherwise is to invite complacency where vigilance is still paramount. Zambians deserve a figure that reflects signed law, not an agreeable promise. The true restructuring percentage is 57 percent, not 94 percent,” Banda said.

He cautioned that failure to conclude the remaining agreements or to secure terms with commercial creditors could undermine the current progress and threaten Zambia’s debt stability.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments