United Bank for Africa (UBA) Plc has announced a landmark pledge of USD 150 million (KES 20.5 billion) to Kenya’s Roads Levy Securitization Program, a USD 1.35 billion initiative spearheaded by the Kenya Roads Board.

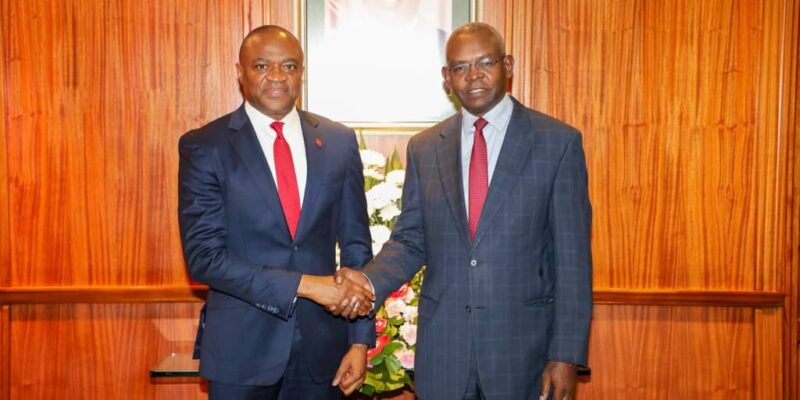

The program, aimed at upgrading critical road infrastructure, accelerating contractor payments, and boosting national connectivity, was confirmed during a meeting between UBA’s Group Managing Director/Chief Executive Officer, Oliver Alawuba, and Kenya’s Cabinet Secretary for Roads and Transport, Mr. Davis Chirchir.

“Infrastructure is the engine of trade, competitiveness and shared prosperity,” Alawuba said. “UBA is proud to be one of the largest financiers of this program, demonstrating our unshakeable confidence in Kenya’s future.”

The announcement was part of a high-level working visit led by Alawuba to the Kenyan President, H.E. William Ruto, and other senior government leaders, reaffirming UBA’s commitment to accelerating investment and supporting inclusive growth in the country.

President Ruto, who hosted the delegation at State House Nairobi, commended UBA for its longstanding support to Kenya and welcomed its strengthened role in the country’s economic transformation.

Read more: UBA Zambia reaffirms commitment to SMEs as 89 local entrepreneurs win US$5,000 TEF grants

Alawuba emphasized UBA’s mission: “Kenya holds a strategic place in Africa’s growth story, and UBA is committed to being a long-term partner in unlocking the immense potential here. From financing critical infrastructure to empowering SMEs that drive job creation, our mission is to deliver sustainable solutions that connect markets, foster trade, and improve lives.”

Accompanied by Executive Director/CEO, UBA Africa, Sola Yomi-Ajayi, and Managing Director/CEO of UBA Kenya, Mary Mulilu, Alawuba also held strategic engagements with senior policymakers and financial regulators.

In a meeting with the Governor of the Central Bank of Kenya, Dr. Kamau Thugge, discussions focused on strengthening financial sector resilience, enhancing cross-border trade through payments innovation, and reinforcing UBA’s strong capital position in Kenya.

Alawuba reassured that UBA has the financial capacity and expertise to support the regulator’s agenda for a sound, well-capitalised, and competitive banking system.

Mulilu added: “Our participation cements UBA’s role as a trusted ally to the Kenyan government, businesses, and communities. We are paving the way for better connectivity that empowers farmers, manufacturers, and SMEs across the country.”

The delegation also met with the Prime Cabinet Secretary of Kenya, H.E. Musalia Mudavadi, where discussions highlighted the critical role of African-led enterprises in driving job creation, innovation, and sustainable growth.

Both parties underscored the importance of robust partnerships to advance infrastructure and regional interconnectivity as foundations for shared prosperity.

“These engagements reaffirm UBA’s commitment to collaborate with governments and stakeholders in building a prosperous, united, and self-reliant Africa,” Alawuba said.

UBA’s activities in Kenya reflect its broader strategy to drive economic transformation across the continent, positioning the country as a vital hub for East Africa and a gateway for regional opportunities under the African Continental Free Trade Area (AfCFTA). With SMEs contributing over 80% of employment in Kenya, UBA is rolling out tailored financing solutions to support entrepreneurship and harness growth opportunities.

About UBA

United Bank for Africa is Africa’s Global Bank. Operating across 20 African countries as well as in the United Kingdom, the United States of America, France, and the United Arab Emirates, UBA provides retail, commercial, and institutional banking services.

The Bank is one of the largest employers in the financial sector in Africa, with over 25,000 employees and more than 45 million customers worldwide.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments