ZANACO has announced a net dividend of K134,377,040.18 to the government, having recorded a profit after tax of K1.79 billion in 2024, up from K1.73 billion in the previous year.

The dividends paid through the Industrial Development Corporation (IDC) and declared in Lusaka on Thursday is an increase from K131,615,868.13 declared by the bank in 2023.

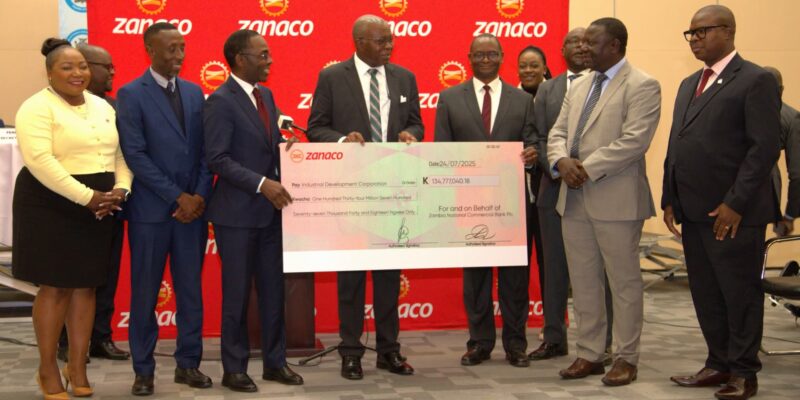

Board Chairperson, Professor Oliver Saasa, presented the dividend cheque at Mulungushi International Conference Centre in Lusaka on Thursday to the Minister of Finance and National Planning, Dr. Situmbeko Musokotwane.

Saasa assured that the bank remained steadfast in placing its customers, employees, communities, shareholders, and the country at the heart of its operations.

“This dividend is not just a financial milestone; it is a reflection of our commitment to supporting Zambia’s economic growth and development agenda,” he said.

Saasa noted that the country’s Gross Domestic Product (GDP) estimate shows that the economy grew by 4.5 percent in Q1 of 2025 compared to 2.2 percent percent in the first quarter of 2024, representing a 2.3 percent increase in growth compared to the same quarter in 2024.

He said while these indicators were encouraging, sustaining growth requires a collaborative effort from all stakeholders.

“ZANACO continues to play its part by offering innovative financial solutions across sectors, empowering businesses and individuals alike,” Saasa assured.

He said by supporting the diverse customer base, Zanaco was unlocking the potential of the private sector to drive Zambia’s economic transformation.

Read More: ZCCM-IH declares K529 million dividend, eyes growth in mining, energy

Saasa stated that beyond profitability, the dividend contributions directly supported government’s efforts to invest in critical infrastructure, spanning commerce, trade, health, education, and industry.

“We are not just a bank; we are a trusted partner in Zambia’s development journey. Our commitment extends to financial inclusion, economic empowerment, and national prosperity,” he said.

He highlighted the bank’s notable support to its customers through the agency banking model, Zanaco Xpress, adding that customers in previously unbanked communities such as Kaputa, Shangombo can now access financial services at a booth near them.

“We are also creating employment opportunities and business opportunities for the agents. With less than five years to go before 2030, where we are looking to be a middle-income country, all the necessary steps by all of us need to be taken to attain the 2030 vision,” Saasa said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments