Bankers have backed introduction of a framework which will compel all exporters to route their earnings through a bank account at a financial institution domiciled in Zambia

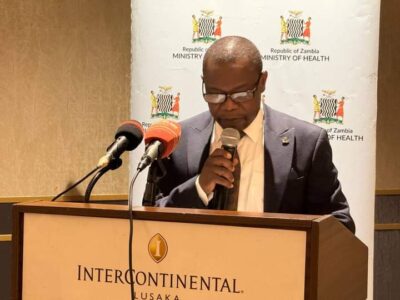

On Monday, Bank of Zambia (BoZ) Deputy Governor-Operations, Francis Chipimo, announced that the Central Bank would soon issue directives to compel all exporters to route their earnings through a bank account at a financial institution domiciled in Zambia.

This will be done through implementation of the Export Tracking Framework by the Central Bank in 2024.

Reacting to this development, Bankers Association of Zambia (BoZ) Chairpeson, Mizinga Melu, in her submission on the 2024 national budget on Monday in Lusaka said the industry was in support of this measure.

“E-BoP reporting of all exports and routing funds into a Zambian bank account. The industry is in support of this measure and is working on finetuning the reporting of reporting of all exports on the E-BoP platform before the commencement date of January, 2024,” Melu said.

Read more: Bank of Zambia to issue directives compelling all exporters to deposit earnings in local banks

Consultations with stakeholders to fully engage and appreciate how the Framework will work already commenced through the Public Private Dialogue Forum (PPDF) and will be scaled up prior to implementation on January 2024.

Melu also commented on the deployment of government services onto Zamportal.

She said this measure would reduce manual transactions and increase the uptake of electronic transactions in the banking sector.

Melu noted that while the intention was to increase the number of services from 280 in 2023 to 382 in 2024, the sector was still a long way considering that government identified at least 1,500 services.

Other areas she touched on in her submission included issuance of the digital biometric identity card- through increased funding of the INRIS project.

“Facilitate the deployment of a centralised electronic know your customer and smoothen and bring in efficiencies in the opening of customer accounts.

“This will also help to reduce identity frauds, moderate lending risks, and help in combating Cyber Crimes,” Melu said.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments