Barrick Gold plans to invest almost US$2 billion in an expansion of its Lumwana copper mine in Zambia, with the purpose of increasing production.

According to mining.com, the project would increase Lumwana’s annual production to an estimated 240,000 tonnes of copper from a 50 million tonnes per annum process plant over a 36-year life of mine, Barrick said on Wednesday.

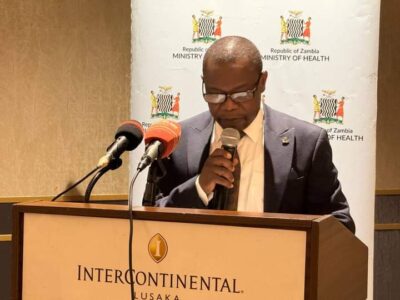

The move is part of the company’s wider plan to extend the life of the mine to 2060 and help Zambia revive its copper industry, Chief Executive Officer, Mark Bristow. said.

“Barrick believes that its host countries are its key stakeholders and that partnering with them creates sustainable value for both of us,” Bristow said.

Read more: Barrick Gold, Zambia, reports lower Q4 copper production at Lumwana mine

Zambia already is Africa’s second-largest copper producer after its northern neighbour, the Democratic Republic of Congo.

Barrick said it aimed to complete the full feasibility study by the end of 2024, bringing the expanded production forward to 2028.

Over the past year, the Canadian gold giant had expressed its intention to add more copper assets to its African portfolio, expanding its presence on the continent’s Copperbelt.

Since Barrick took over operations at Lumwana in 2019, the once-unprofitable operation had contributed almost US$3 billion to the Zambian economy in the form of taxes, royalties, salaries and the procurement of goods and services.

The Toronto-based miner said 99.3 percent of Lumwana’s current workforce is made up of Zambian nationals.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments