Oxfam Zambia and the Centre for Trade Policy and Development (CTPD) on Wednesday called on the Zambian government to commission an independent forensic audit of debts contracted between 2011 and 2021 to determine whether any qualify as odious or illegitimate.

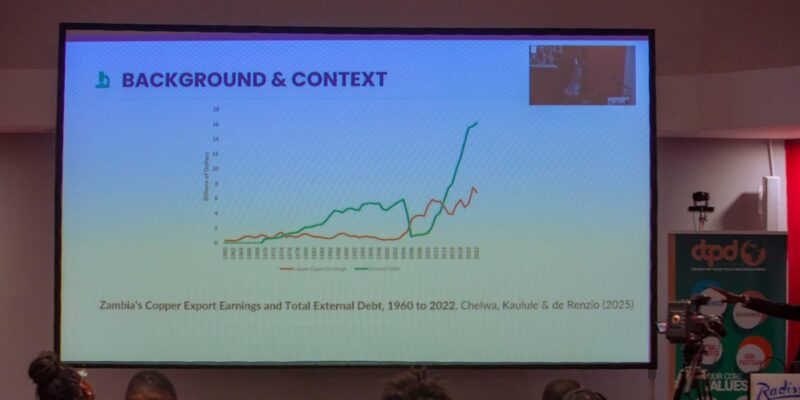

In a joint fiscal report titled From Aspirations to Reality, the two organisations said Zambia’s fiscal choices had been shaped by external shocks and the competing demands of debt servicing and public investment in sectors such as health, education and infrastructure.

Presenting the report in Lusaka, Lead Researcher and Development Economist Peter Magati said Zambia needed fiscal strategies that balance debt sustainability with social and economic development.

The report said the findings of the proposed audit should inform upcoming negotiations with creditors, noting that any determination of odious debt could influence the country’s economic trajectory.

It explained that in international legal theory, odious debt refers to obligations incurred without public consent or benefit, often linked to corruption or a lack of transparency. “The findings of a forensic audit could strengthen government’s position in ongoing debt restructuring negotiations,” the organisations said.

The report also urged the government to expand its domestic revenue base, including through widening the tax net to cover more of the informal sector, which employs about 90% of the labour force.

It said loans linked to non-performing infrastructure or undisclosed liabilities could be candidates for cancellation or deeper creditor haircuts if found to lack legal validity under Zambian law.

Magati added that addressing illicit financial flows was essential to restoring fiscal health. He recommended strengthening tax administration, implementing wealth and inheritance taxes and adopting a unitary taxation approach for multinational corporations.

The report further called for deeper engagement with African multilateral financial institutions such as the African Development Bank, arguing they provide more responsive financing and should retain Preferred Creditor Status, often challenged during restructuring by Bretton Woods institutions.

At the same event, Oxfam Country Focal Point Chitimbwa Chifunda said the International Monetary Fund’s Extended Credit Facility had provided fiscal discipline, and she commended the expansion of the Social Cash Transfer programme.

“But the real-world value of social protection has been eroded by inflation and subsidy removals, leaving many households in survival mode,” she said.

Chifunda added that recommendations such as broadening the tax base, adopting zero-based budgeting and improving transparency in debt management were pathways to financial sovereignty and a stronger social contract.

She said true recovery would depend on consistent delivery of quality public services, including healthcare, education, water and sanitation, and climate resilience measures for vulnerable communities.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments