First Alliance Bank Zambia Ltd and the Zambia Credit Guarantee Scheme (ZCGS) have entered into agreement aimed at enhancing access to finance for Small and Medium Enterprises (SMEs) across the country.

Under the agreement, ZCGS will provide partial credit guarantees to qualifying SME borrowers through First Alliance Bank, enabling increased lending with reduced collateral requirements.

Speaking during the signing ceremony, representatives from both institutions emphasized the importance of strengthening public-private collaboration to stimulate inclusive financial services and unlock SME potential.

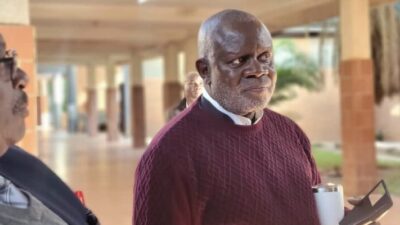

Dr. Kuldip Paliwal, Chief Executive Officer of the First Alliance Bank noted that since inception, ZCGS had built a robust ecosystem of trust, expertise, and collaboration, amongst banks, government, and private sector to bridge the credit gap.

“For over 30 years, being a Zambian Bank, FAB has grown alongside Zambia, with a vision to be Zambia’s trusted partner in prosperity,” Paliwal said.

He stated that the bank was evolving into a dynamic, tech-driven bank, focussing on financial inclusion and fuelling entrepreneurship to empower Zambian economy.

Paliwal said the bank this year unveiled a bold five-year strategy anchored on customer-centricity, digital innovation, and, above all, the growth of Small, and Medium Enterprises (SMEs).

“These businesses are Zambia’s heartbeat. SMEs contribute 70 percent of Zambia GDP and 80 percent employment. They drive jobs creation, spark innovation, and strengthen our communities,” he noted.

Paliwap said the collaboration also deepened the bank’s commitment to inclusive growth by Women-led businesses, youth entrepreneurs, and innovations .

In her remarks, ZCGS Chief ExecutiveOfficer Mary Mumba said the formal agreement was a demonstration of the shared vision to strengthen Zambia’s small and medium enterprise sector and broaden access to financial solutions that drive inclusive economic growth.

“At ZCGS, our core mandate has always been to bridge the financing gap faced by many MSMEs that have the potential to transform our economy but lack sufficient collateral to access affordable credit,” Mumba said.

Mumba commended the leadership and the entire team at the bank for recognising the critical role of credit guarantees in unlocking financing for businesses that need it most.

“We are confident that this partnership will deliver tangible results, supporting a resilient private sector and contributing to the broader aspirations of Zambia’s economic agenda,” she stated.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments