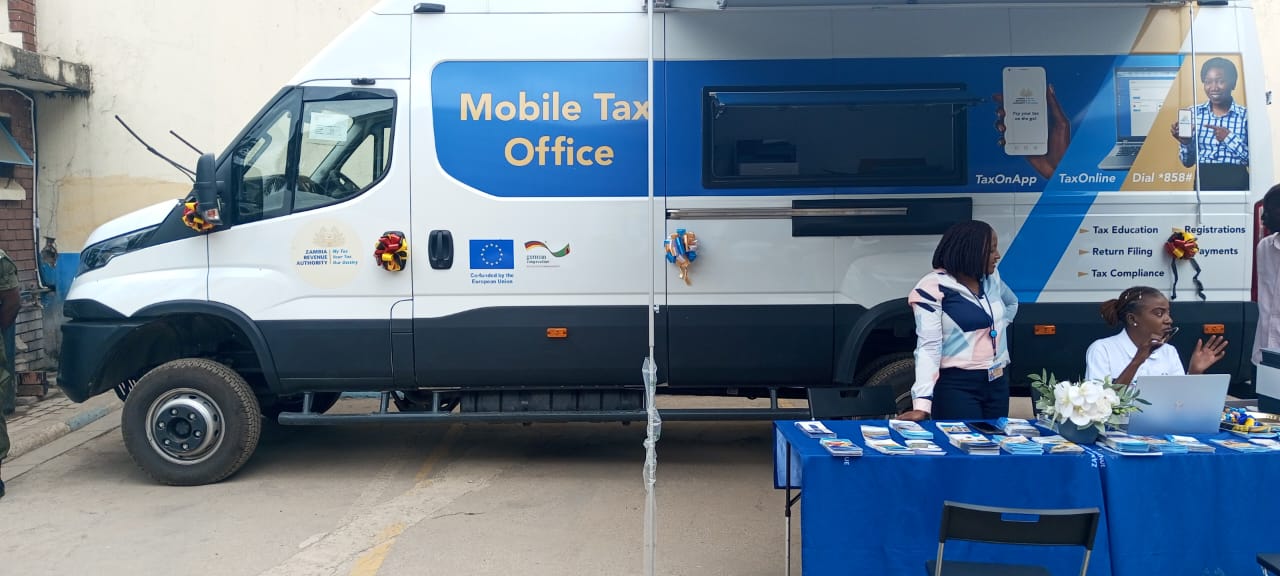

Zambia Revenue Authority (ZRA) has unveiled two mobile tax offices meant to enhance tax collections, particularly in rural areas.

Commissioner General Dingani Banda said the initiative was a game changer especially for the rural communities, who have limited access to tax administration.

The mobile tax offices have been procured with the support of the GIZ.

Speaking during the launch of the two mobile tax offices in Lusaka on Wednesday, Banda said this was part of the Authority’s corporate strategic pillar of customer focus and collaboration.

“The mobile tax office we are launching today was procured at a total cost of 350,000 euros.

“I am confident that this tax office van will go a long way in improving tax compliance in our country and enhance the relationship between the ZRA and the taxpayers,” Banda said.

He explained that the vehicle had a state-of-the-art technology that had been designed to take tax services directly to the people, no matter where they were.

“The Zambia Revenue Authority has offices in 37 out of the 116 Districts of Zambia. This is where the mobile tax office van comes in,” he said.

Speaking at the same event, German Ambassador to Zambia Anne-Wagner Mitchell, said the mobile tax offices would assist ZRA bring services closer to its customers in Zambia.

Mitchell, who was also representing the European Union delegation, said the initiative would leverage the Authority outreach, enhance taxpayer education and improve service provision.

She also expressed concern at the low presence of ZRA offices across the country, stating that ZRA has presence in 37 out of the 116 Districts of Zambia.

“This number strikes me as low. It poses a challenge for taxpayer service provision and often contributes to lower levels of tax literacy and tax compliance.

“It is simple, if taxpayers are not aware of their obligations and have no access to tax services, they will be less likely to make their contributions. And this is where mobile tax offices are so important,” Mitchell said.

Meanwhile, Ministry of Finance and National Planning Acting Permanent Secretary for Budget and Economic Mwaka Mukubesa, said the initiative was an important step in enhance voluntary tax payments.

Mukubesa said the mobile tax offices were part of the Government’s strategy to improve taxpayer education and public service delivery aimed at contributing to maximising domestic revenue mobilisation.

“Through mobile tax offices, it is expected that ordinary citizens and specially Micro, Small and. Medium Enterprises were also educated about the various tax incentives that were available for them to take advantage for their own growth,” she said.

Mukubesa indicated that these would help grow the Zambia economy and generate decent jobs for households in the grassroots.

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments